Read on to learn how optimising existing accounts, coupled with the capabilities of assessing incoming business can help Cargo Underwriters make more informed decisions.

We previously outlined the scope of a digital environment for Cargo Insurance and how it moves an organisation to exposure-based underwriting. Geographical exposure, real-time aggregation, and a wealth of insights from improved data distribution will improve the visibility of risk at all levels of the organisation. Methods of optimisation that relate to pricing and good risk selection will not only impact decisions around new business, but also allow for a re-evaluation of existing business.

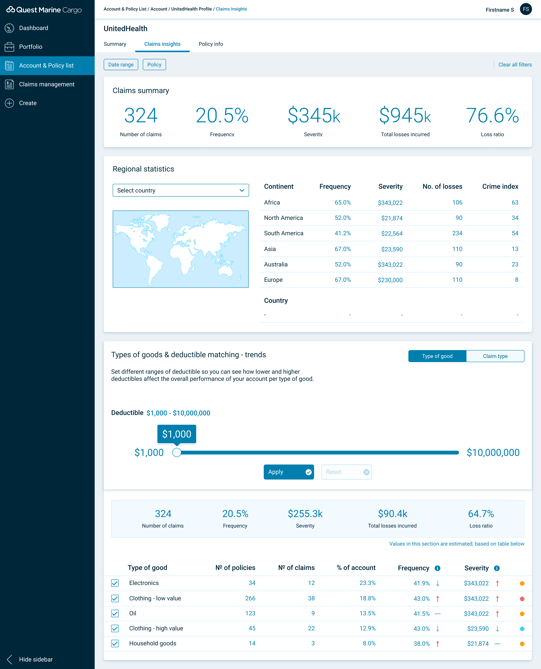

Quest Marine Cargo offers the ability to simulate underwriting decisions through deductible matching. The feature allows users to see the impact of increased deductibles not only on overall account performance, but also for specific commodities or causes of loss within the account. Insights gained using this feature can inform renewal decisions for individual accounts and impact the risk appetite for certain commodities based on their performance across the portfolio.

The deductible matching feature is modelled around the frequency and severity of specific commodity types. Due to the plethora of commodity types in circulation, those considered are grouped into set categories that share traits. Such categories are not standardised across the industry.

Table 1: Grouped commodity categories in Quest Marine Cargo

Grouping goods based on commodity description leads to more relevant and granular categories. By tying a value to commodity types, the accumulation of that commodity type at any one point in time can be deduced whilst in transit. This use of automation is highly influential as it supplies a level of visibility that is not yet available in the market to date.

Deductible matching is a powerful tool in optimising policy terms and offers Underwriters the ability to test hypotheses before writing business. When reviewing the total incurred losses, users can see the impact of frequency and severity per good type on the overall result. Varying the deductible has a direct influence on these calculations, leading to the simulated change in loss ratio. This is particularly useful for Underwriters working at the digitally informed section of the placement pyramid as it facilitates decisions around exposure management and appetite.

With a method of optimising existing accounts, coupled with the capabilities of assessing incoming business in an extensive way, Cargo Underwriters will be able to make more informed decisions. When applied at scale it will translate to profitability, allowing companies to further improve their position in a hardening market. This is especially important because whilst rates are increasing, it is not currently at the extent to make up for losses accumulated over time, so profitability cannot be guaranteed from a hardening of the market alone.

It is clear how one single digital platform can enable the necessary processes to deliver the tiered approach to a new placement model, whilst ensuring consistency in allowing professionals to draw from the same data lake. New syndicates and established organisations are already seeing the potential of digital platforms within the Cargo sector transform their approach to underwriting.

Figure 6: Deductible matching within Quest Marine Cargo

For more on our approach to Cargo Insurance, download at our white paper