This article outlines how technology is being used to enhance the consideration and processing of risk by marine insurers. The benefits of applying this technology include:

- Increased capacity of underwriting teams through faster risk assessment

- Better placement and prioritisation of risk within an organisation

- On-going visibility of portfolio health and how underwriting decisions align with strategy

- Tools to implement changes in strategy and manage the quality of risk underwriters consider

Download our submissions white paper below.

Download white paper

Beyond data entry

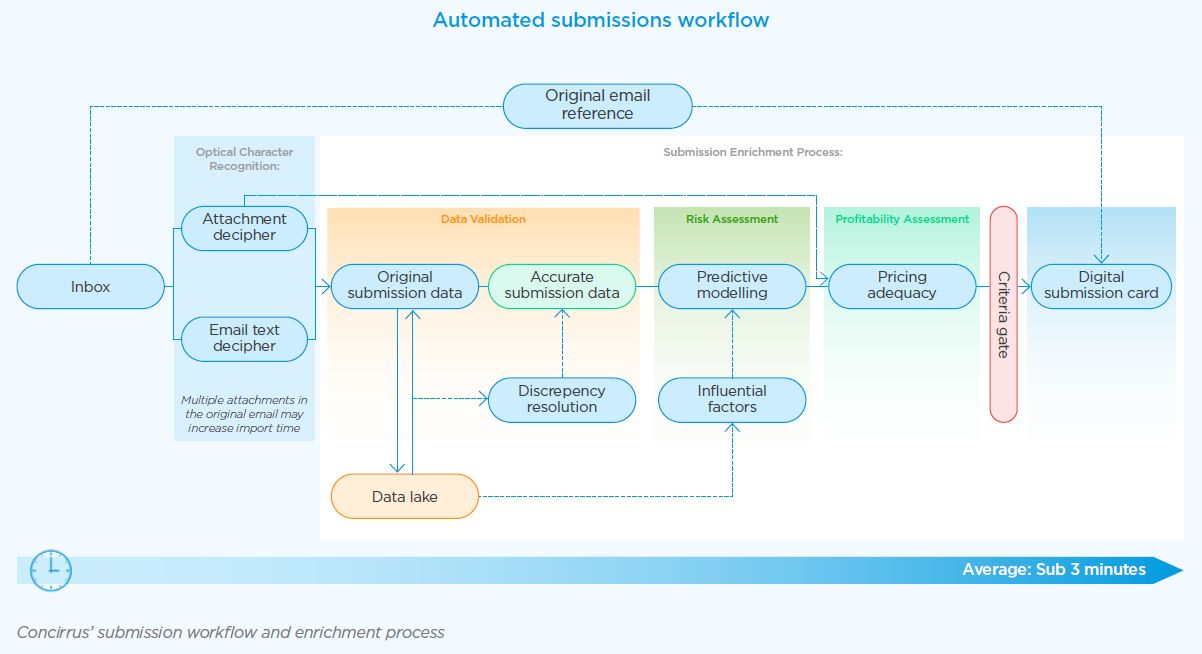

Submissions management technologies can do more than automate the process of importing digital submissions. For example, with Concirrus’ solution, each submission passes through an analytics workflow during data import. Risk metrics are calculated, including price adequacy, and presented at the forefront of each submission.

Visibility of key metrics accelerates an underwriters ability to identify and prioritise business that’s in appetite. Senior managers can apply rules based on metrics to filter submissions that don’t align with strategy.

Automation and accuracy

Leveraging a comprehensive data lake means data in the submission can be verified against validated records. This helps prevent common issues found in digital submissions:

- Errors in systems that affect dependent tasks, like modelling and claims, arising from poor data transfer from submission to online system.

- Loss of business due to long manual validation and resolution of data

A reliable and automated data validation process reduces long-term costs due to data entry errors without severely extending the time taken to process a submission. Validation includes the resolution of common issues such as missing IMO numbers, vessel status, and policy premium.

Capacity and selection

Loss metrics are crucial when deciding whether business is in appetite. Underwriters can make informed decisions quickly when key metrics are provided as soon as a submission reaches them. Accelerating the process of risk triage increases the capacity of underwriting team so they can consider more business.

A risk score, expected loss, and price adequacy can be determined by adding modelling to the data import process. Concirrus’ pricing capabilities include behavioural analytics, providing a more accurate assessment of individual vessel risk. Underwriters can see what has the greatest influence on risk score.

Strategy and collaboration

The use of one digital environment means all underwriters can collaborate on the placement and triage of risk remotely. The most experienced professional can work on the most appropriate risk, whilst juniors can train using digital tools to assist their decision making.

Strategy itself can be influenced through an ongoing understanding of how new business and renewals affect a portfolio. Each underwriting decision made using the submissions module is captured and presented in a dashboard. The dashboard provides real-time management information relating to hit rate, business quality via risk score, and reasons for loss/declinature. A constant stream of intelligence relating to business performance accelerates strategic decision making.

Applying success criteria to inbound submissions means those decisions are actioned instantly, filtering undesirable business before it reaches the underwriting team. This leads to a more agile operation that can respond to short-term market changes in favour of a long-term strategy.

Download our submissions white paper below.

Download white paper

Talk to us on how technology is transforming submissions for insurers today!